portland oregon sales tax rate 2020

The current sales tax rate in Oregon OR is 0. 2022 Oregon state sales tax.

:max_bytes(150000):strip_icc()/shutterstock_178351457-5bfc365646e0fb00517e18e7.jpg)

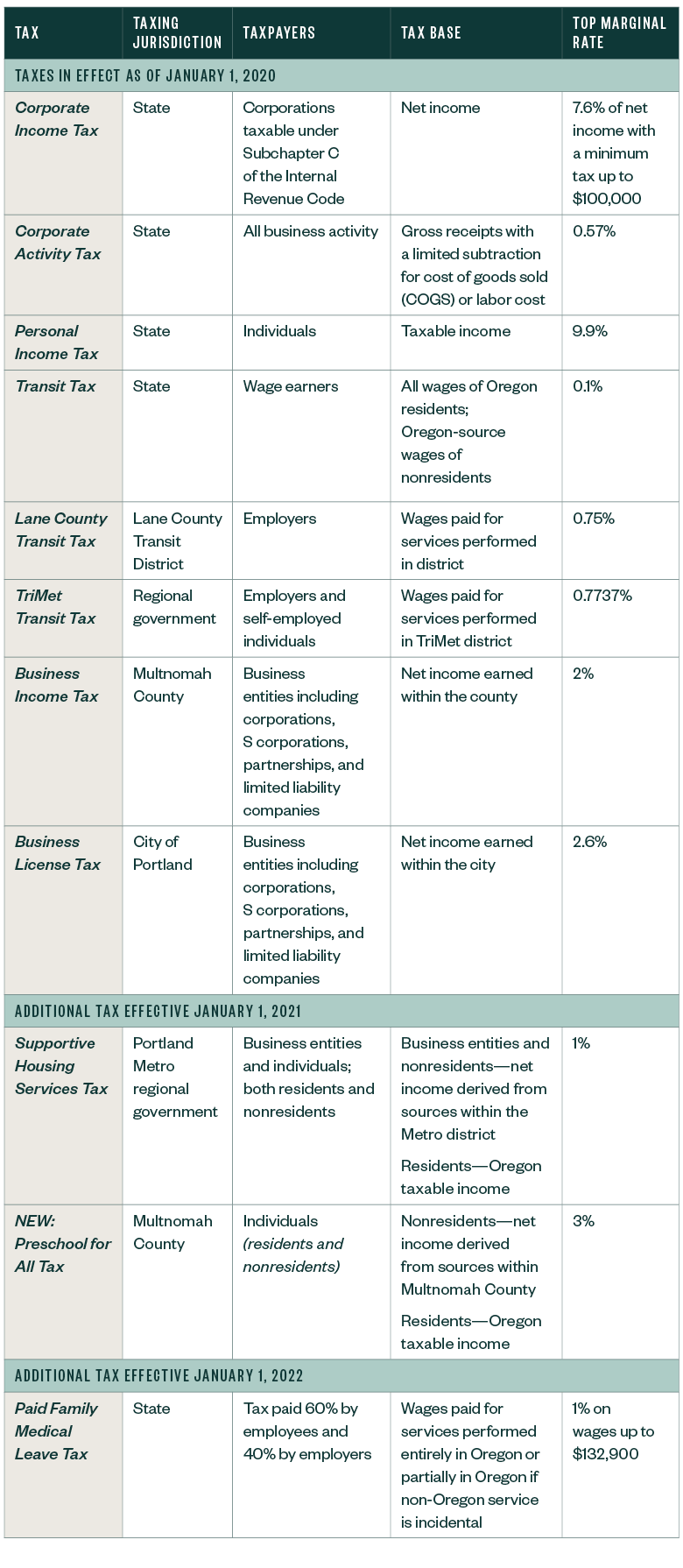

Taxes In Oregon For Small Business The Basics

Taxable base tax rate.

. Base State Sales Tax Rate. Oregon has a 660 percent. Combined Sales Tax Range.

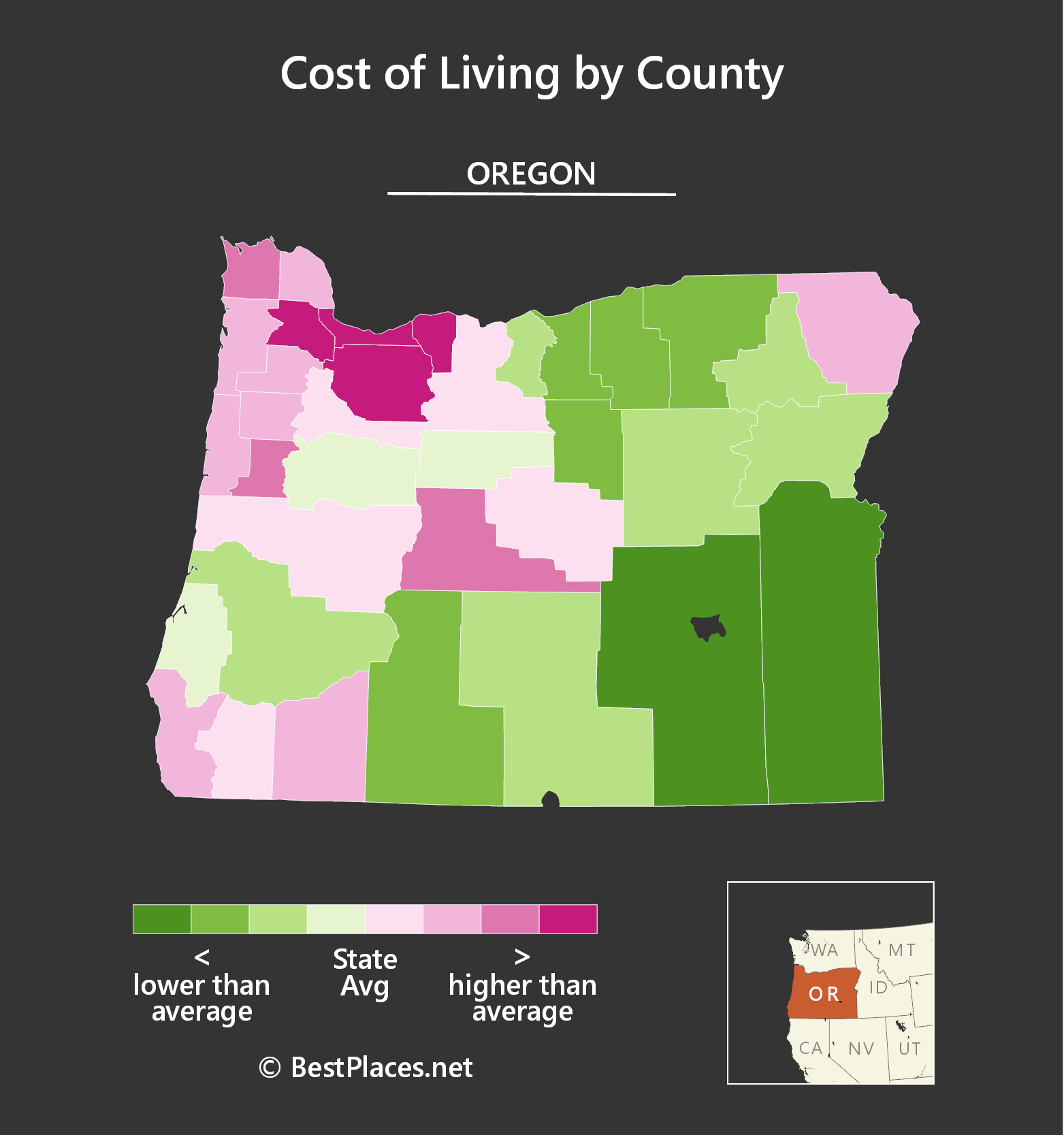

Bureau of Financial Services. Property taxes rely on county assessment and taxation offices. Some rates might be different in Portland.

Tax rates last updated in January. The Portland sales tax rate is NA. For tax years beginning on or after January 1 2019 the Clean Energy Surcharge CES is a 1 surcharge on Retail Sales within the City of Portland imposed on Large Retailers.

This is the total of state county and city sales tax rates. Oregon has a graduated individual income tax with rates ranging from 475 percent to 990 percent. For example under the South Dakota law a company must collect sales tax for online retail sales if.

Current Tax Rate Filing Due Dates. This rate includes any state county city and local sales taxes. Sales tax region name.

Portland OR Sales Tax Rate. Part-year resident and nonresident Form OR-40-P and Form OR-40-N filers. Sales Tax Calculator Sales Tax Table.

Oregon cities andor municipalities dont have a city sales tax. The company conducted more than 200. Full-year resident Form OR -40 filers.

Oregons sales tax rates for commonly exempted categories are listed below. Local Sales Tax Range. The County sales tax.

To this end we show advertising from partners and use Google Analytics on our website. Please complete a new registration form. 2020 rates included for use while preparing your income tax deduction.

While many other states allow counties and other localities to collect a local option sales tax Oregon does not. Portland Tourism Improvement District Sp. 2021 tax y ear rates and tables.

Exact tax amount may vary for different items. The Portland Oregon sales tax is NA the same as the Oregon state sales tax. The rate was reduced to 145 in 1993 when the City and.

24 new employer rate Special payroll tax offset. The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. There are also jurisdictions that collect local income taxes.

The minimum combined 2022 sales tax rate for Portland Oregon is. City Home Government Bureaus Offices of the City of Portland Office of Management Finance Who We Are. Rates include state county and city taxes.

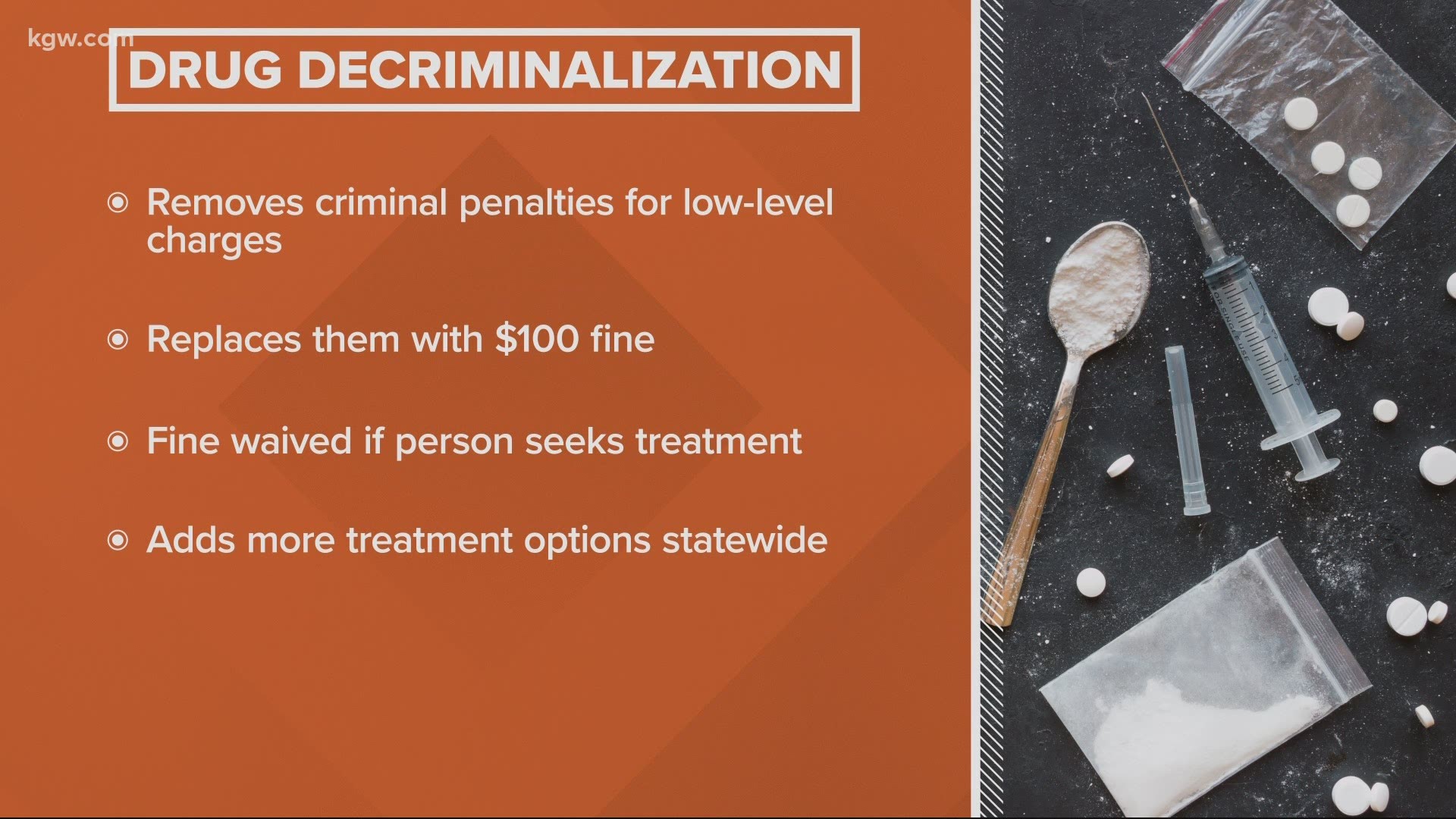

In 2019 property taxes to pay for this bond will go up by 24 cents per. Despite the lack of a state sales. The Oregon sales tax rate is currently.

The total amount to be raised through property taxes is nearly 653 million over the course of 30 years. In 2019 and 2020. The state sales tax rate in Oregon is 0000.

The Portland Oregon sales tax is NA. The property tax system is one of the most important sources of revenue for more than 1200 local taxing districts in Oregon. Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland Portland Salem Beaverton and Eugene and 102 other cities.

Oregon cities andor municipalities dont have a city sales tax. The companys gross sales exceed 100000 or. If you have requested an extension of time to file.

2020 rates included for use while preparing your income tax deduction. The payment for your businesses taxes is due at the same time you file and pay your federal and state taxes generally April 15 for most filers.

Sales Taxes In The United States Wikipedia

20 Honest Pros And Cons Of Living In Portland Oregon Tips

Blog Oregon Restaurant Lodging Association

A Portrait Of Poverty In Oregon Oregon Center For Public Policy

Here S Why You Should Not Charge Sales Tax For Your Paparazzi Jewelry Shopasetup

Cat S Out Of The Bag A Look At Gross Receipts Taxes In No Sales Tax States Sales Tax Institute

2022 Property Tax Rates In Portland Oregon Virtuance

New Portland Tax Further Complicates Tax Landscape

State Sales Tax Rates 2022 Avalara

New Laws That Take Effect In Oregon And Portland In 2021 Kgw Com

The Cost Of Living Battle Oregon Vs Idaho Real Estate With Tazz

Oregonians Must Pay Washington Sales Tax And File For A Refund Later Are They Katu

Cost Of Living In Pdx Vs California Living In Portland Oregon

Portland Property Taxes Going Up In 2022 Real Estate Agent Pdx

High Earners In Portland Area Navigate Confusion Over New Personal Income Taxes Kgw Com

Study Shows Multnomah County Will Have Nation S Highest Income Taxes For High Income Earners If Preschool Measure Passes